Insurance Meets DeFi:

Unlock a New Asset Class

Insurance Meets DeFi:

Unlock a New Asset Class

Ensuro is the first licensed blockchain-based (re)insurance company that allows DeFi investors to diversify their portfolios with real-world insurance risk.

Embed bespoke

coverage in a snap

Powered by regulated capital, automated policy management, and real-time risk analytics. Ensuro lets you launch flexible protections where your users need it most

Your turn key solution

Your turn key solution

Technology + Capital + Compliance

Technology + Capital + Compliance

Decentralized Investing Made Simple

Decentralized Investing Made Simple

We use smart contracts and stablecoins to offer investment opportunities uncorrelated with traditional markets.

We use smart contracts and stablecoins to offer investment opportunities uncorrelated with traditional markets.

Regulated & Secure

Regulated & Secure

Earn returns within a fully regulated framework by the Bermuda Monetary Authority.

Earn returns within a fully regulated framework by the Bermuda Monetary Authority.

Real-Time Transparency

Real-Time Transparency

Track capital deployment and risk exposure anytime via our blockchain-based system.

Track capital deployment and risk exposure anytime via our blockchain-based system.

How we work

How we work

How we work

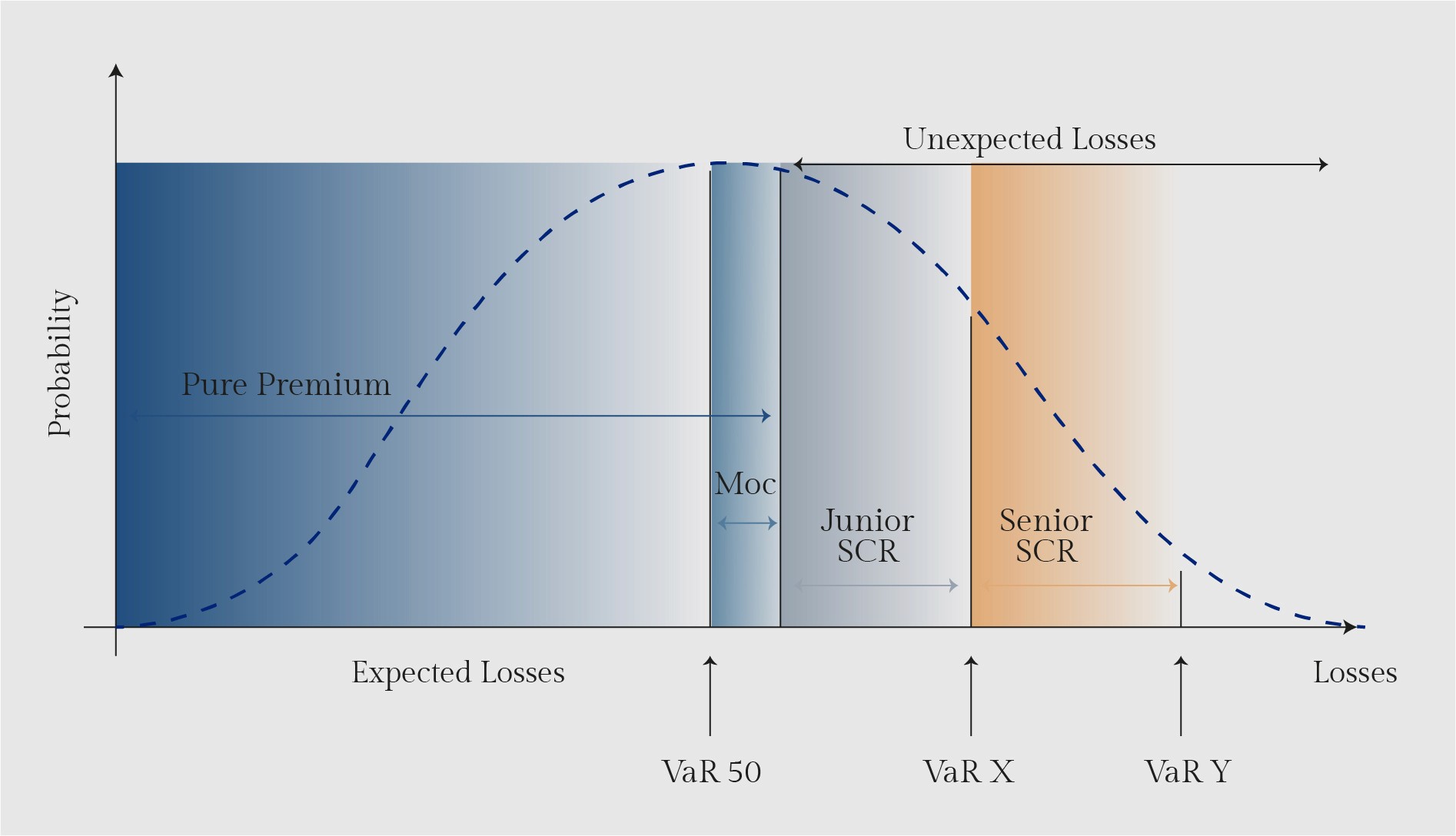

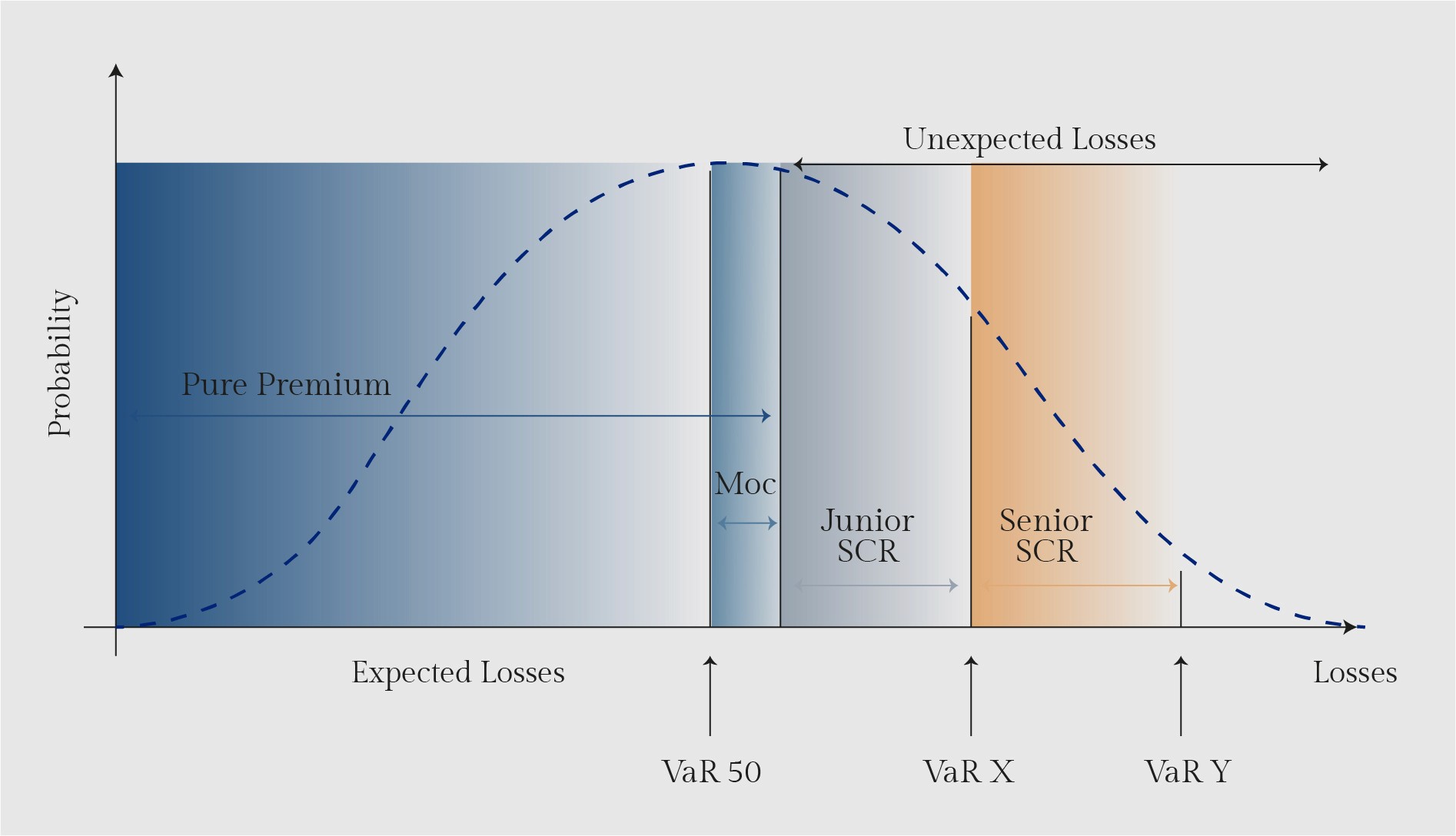

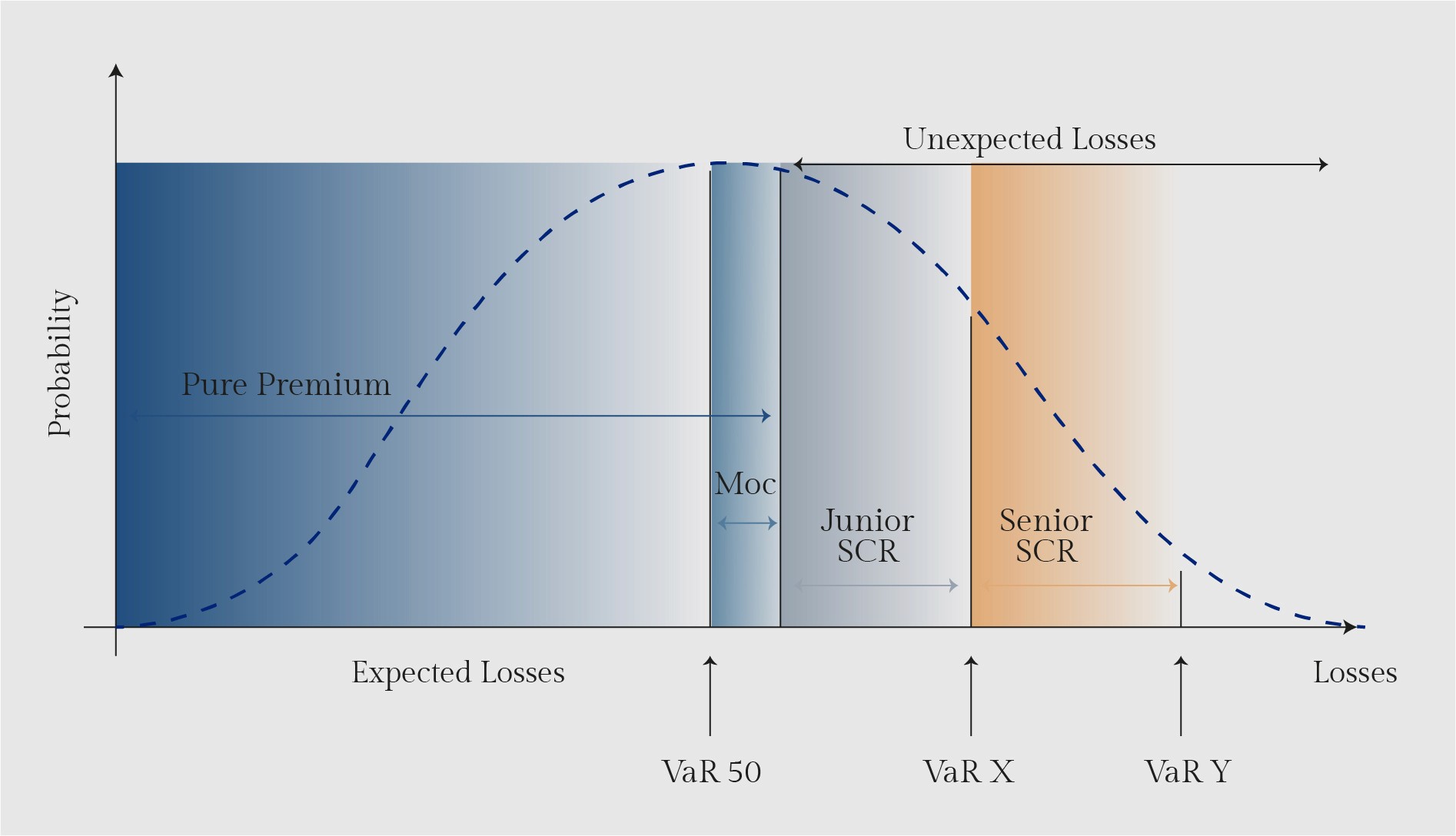

Ensuro offers two structured investment tranches, aligning with different risk appetites

Ensuro offers two structured investment tranches, aligning with different risk appetites

Junior Tranche

Junior Tranche

First to absorb losses after pure premiums are exhausted.

Tied to specific partners and risks.

Offers higher, riskier returns.

First to absorb losses after pure premiums are exhausted.

Tied to specific partners and risks.

Offers higher, riskier returns.

Senior Tranche

Senior Tranche

Activated only after Junior capital is depleted.

Diversified exposure across multiple partners (e.g., Otonomi, Koala, Spot).

Offers lower, safer returns.

Activated only after Junior capital is depleted.

Diversified exposure across multiple partners (e.g., Otonomi, Koala, Spot).

Offers lower, safer returns.

Why invest with Ensuro

Why invest with Ensuro

Uncorrelated Returns

Insurance risks aren’t tied to crypto or equity markets, ensuring diversification.

Uncorrelated Returns

Insurance risks aren’t tied to crypto or equity markets, ensuring diversification.

Uncorrelated Returns

Insurance risks aren’t tied to crypto or equity markets, ensuring diversification.

Regulated & Secure

Fully licensed by the Bermuda Monetary Authority, with smart contracts audited by experts.

Regulated & Secure

Fully licensed by the Bermuda Monetary Authority, with smart contracts audited by experts.

Regulated & Secure

Fully licensed by the Bermuda Monetary Authority, with smart contracts audited by experts.

Transparent & Real-Time

Monitor investments live on our intuitive dashboard.

Transparent & Real-Time

Monitor investments live on our intuitive dashboard.

Transparent & Real-Time

Monitor investments live on our intuitive dashboard.

Flexible Options

Choose between Junior (higher risk/return) and Senior (lower risk/return) pools.

Flexible Options

Choose between Junior (higher risk/return) and Senior (lower risk/return) pools.

Flexible Options

Choose between Junior (higher risk/return) and Senior (lower risk/return) pools.

Stablecoin-Based

All investments are made in USDC, avoiding crypto market volatility.

Stablecoin-Based

All investments are made in USDC, avoiding crypto market volatility.

Stablecoin-Based

All investments are made in USDC, avoiding crypto market volatility.

What our partners say

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

What our partners say

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

What our partners say

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

Dante Disparte

Ensuro is pioneering blockchain‑based insurance for previously uninsurable risks, leveraging Bermuda’s robust regulatory environment to offer a trusted, fully regulated platform. It’s a game‑changer for investors, customers, and counterparties looking for innovative insurance solutions.

Clorinda Mántaras

The partnership with Ensuro reinforces our goal to remain at the forefront and build a tangible bridge between the DeFi world and the insurance industry. The anticipation of what tomorrow brings and the possibility of co-creating innovations together is exciting.

Justin Havins

DeFi capital can now be used to access a new asset class, as Ensuro's innovative solution can bridge the gap between DeFi and real-world risk. Blockchain has the potential to bring more transparency and efficiency to insurance, an industry that has been reluctant to change. We are proud that they have decided to build their protocol on Polygon.

FAQs

How to Invest?

What Are the Risks?

Minimum Investment?

How to Become a Liquidity Provider?

Supported Stablecoins?

How Are Returns Generated?

Is My Capital Crypto-Volatility Resistant?

Withdrawal Policy?

How to Invest?

What Are the Risks?

Minimum Investment?

How to Become a Liquidity Provider?

Supported Stablecoins?

How Are Returns Generated?

Is My Capital Crypto-Volatility Resistant?

Withdrawal Policy?

How to Invest?

What Are the Risks?

Minimum Investment?

How to Become a Liquidity Provider?

Supported Stablecoins?

How Are Returns Generated?

Is My Capital Crypto-Volatility Resistant?

Withdrawal Policy?

Let’s Build Together

Let’s Build Together

Ensuro gives you control of protection, capital, and customer experience—without the cost and complexity.

Connecting Capital to Coverage Unlocking the Future of Insurance

Product & Resource

Connecting Capital to Coverage Unlocking the Future of Insurance

Product & Resource

Connecting Capital to Coverage Unlocking the Future of Insurance

Product & Resource